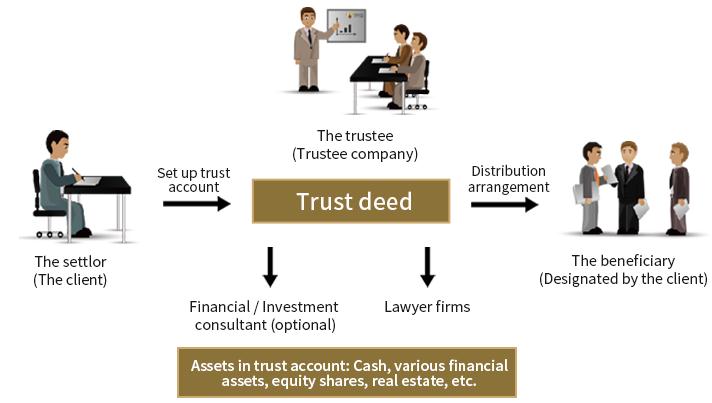

Trust exists in the form of trust deed which is the result of thorough consideration. Once a trust deed becomes effective, it must be executed faithfully as it is the very essence of trust relationship.

The Three Parties involved in Trust——The settlors、The trustee、The beneficiary.

An individual who transfers the title of his assets to a trustee The Settlor is the person who sets up a trust. He should be a natural person, legal person or other organization established by law with full civil capacity. He is the owner of the wealth to be put in a trust, capable to designate the beneficiary of the wealth, appoint trustee and monitor its performance in execution of the trust deed.

The wealth management body who will manage the asset in trust account for the settlor The Settlor is the person who sets up a trust. He should be a natural person, legal person or other organization established by law with full civil capacity. He is the owner of the wealth to be put in a trust, capable to designate the beneficiary of the wealth, appoint trustee and monitor its performance in execution of the trust deed.

The trustee allocates the assets in trust account to the beneficiary according to relevant trust deed The beneficiary is entitled to the benefits of the wealth managed by a trustee. He should be a natural person, legal person or other organization established by law with full civil capacity. The beneficiary of charity trust should be the people in the public.

Trust customer can be relieved from heavy taxation (e.g. estate tax) and charges (e.g. government rate) due to the transfer of ownership to trustee.

Trust customer will not suffer loss or damage to his/her asset due to personal adversity or liabilities.

Listening to you wholeheartedly is a crucial step for our understanding of your wealth inheritance plan and its objectives.

By thorough discussion with you and in-depth analysis, the trust specialist is certainly able to deliver professional trust inheritance plan to you, which will meet your every objective. The trust company will adhere to the law and regulations for execution of your trust plan and exert utmost to mitigate possible risks so as to achieve wealth inheritance and capital growth for you.

By understanding your specific needs, the trust company can certainly tailor-make a trust plan dedicated to serve such needs the best by proper allocation of the assets in your trust.

Your Trust Manager will implement your trust plan that is tailor-made for you in conformity to your desire.

The trust company will monitor and evaluate the performance of the trust plan on regular basis and make necessary adjustment to the allocation of the assets in trust to meet your needs.